What is GST Audit

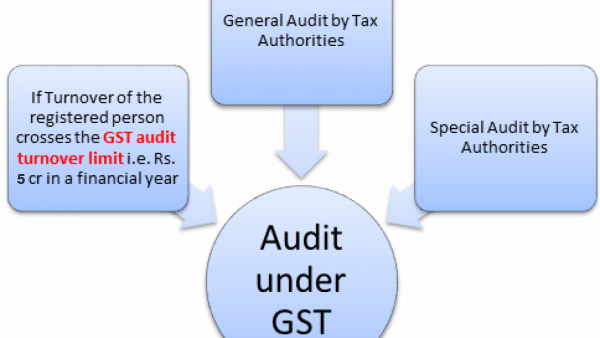

Audit under GST is the process of examination of records, returns and other documents maintained by a taxable person. The purpose is to verify the correctness of turnover declared, taxes paid, refund claimed and input tax credit availed, and to assess the compliance with the provisions of GST.

GST Audit will apply every annual year for that GST registered a business (GSTIN) having turnover more than Rs 2 crores

Forms of Annual Return and GST Audit:

| Type of taxpayer | Form to be filed |

|---|---|

| Whether or not applicable to GST Audit | |

| A Regular taxpayer filing GSTR 1 and GSTR 3B whose turnover exceeds Rs.2 Crores in Financial Year | GSTR-9 |

| A Taxpayer under Composition Scheme | GSTR-9A |

| E-commerce operator | GSTR-9B |

| Applicable for GST Audit | |

| Taxpayers whose turnover exceeds Rs.5 Crores in Financial Year | GSTR-9C |

Submission: GST Audit Report and Annual Returns

The Completed GSTR-9C can be certified by the management.

We help the management for preparing the following:

- Whether or not all the essential accounts or records are maintained.

- Whether or not the Financial Statements are prepared as per the books of accounts maintained at the principal place of business or additional place of business of the taxpayer.

- Certify the accuracy of the information in GSTR-9C.

- To list down the audit observations or reservations or comments

NOTE: DUE DATES FOR SUBMISSION OF GST AUDIT REPORT

GSTR-9 and GSTR-9C are due on or before 31st December of the subsequent budgetary year.